The U.S. is accelerating its transition to electric vehicles (EV) to address climate change. However, obtaining the minerals and metals required for EV batteries remains a challenge.

In this infographic from Talon Metals and Li-Cycle, we explore the country’s strategy to have vehicles, batteries, and key parts be made in the United States.

Then, we look at how this strategy could be fueled by domestic mining and battery recycling.

The All-Electric America

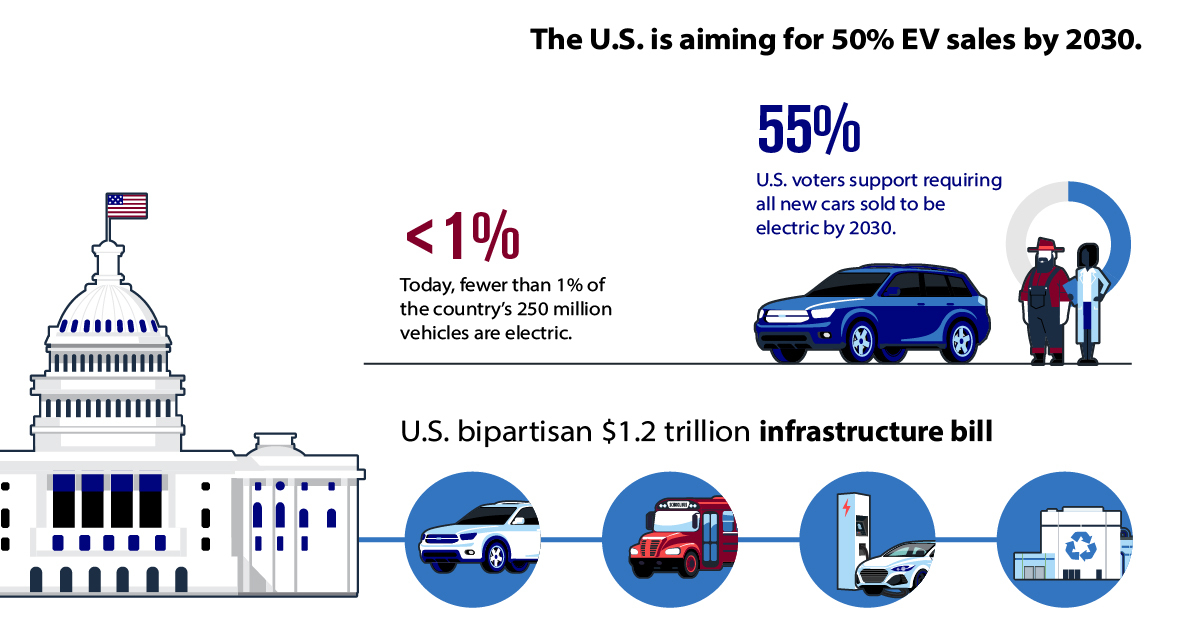

Gasoline-powered cars are one of the biggest sources of carbon pollution driving the climate crisis. As a result, the Biden Administration has set a target for EVs to make up 50% of all new car sales in the U.S. by 2030. Today, fewer than 1% of the country’s 250 million vehicles are electric.

In November 2021, Congress passed the Bipartisan Infrastructure Deal, which includes:

- Replacing the government’s 650,000 vehicle motor pool with EVs.

- Electrifying 20% of the country’s 500,000 school buses.

- Investing $7.5 billion to build out a network of 500,000 electric vehicle chargers across the country.

The idea also has popular support. According to a poll, 55% of voters in the U.S. support requiring all new cars sold in their state to be electric starting in 2030.

However, rising EV sales are already driving demand for battery metals such as nickel, lithium, and copper, threatening to trigger a shortage of these key raw materials. So, does the U.S. have the raw materials needed to meet this rising demand?

Currently, the U.S. is import-dependent with large parts of the battery supply chain captured by China. Likewise, some essential metals for EVs are currently extracted from countries that have poor labor standards and high CO2 footprints.

Nickel in the Land of Opportunity

The Biden Administration’s 100-day review of critical supply chains recommended the government should prioritize investing in nickel processing capability.

Today, the only operating nickel mine in the U.S., the Eagle Mine in Michigan, ships its concentrates abroad for refining and is scheduled to close in 2025.

To fill the supply gap, Talon Metals is developing the Tamarack Nickel Project in Minnesota, the only high-grade development-stage nickel mine in the country. Tesla has recently signed an agreement to purchase 75,000 metric tonnes of nickel in concentrate from Tamarack.

Since the development and construction of a mine can take many years, recycling is considered an essential source of raw material for EVs.

The Role of Battery Recycling

Battery recycling could meet up to 30% of nickel and 80% of cobalt usage in electric vehicles by the end of the decade.

The bipartisan $1.2 trillion infrastructure bill already sets aside $6 billion for developing battery materials processing capacity in the United States.

By 2030, the U.S. alone is projected to have more than 218,000 tonnes of EV battery manufacturing scrap and 313,000 tonnes of end-of-life EV batteries per year, presenting a massive opportunity for recycling. Currently, Li-Cycle, a leading lithium-ion battery recycler in North America, can process up to 10,000 tonnes of battery material per year—and this capacity is set to grow to up to 30,000 tonnes by the end of 2022.

Li-Cycle also has a hydrometallurgy refinement hub under construction in Rochester, New York, which will process up to the equivalent of 225,000 EV batteries annually into battery-grade lithium, nickel, and cobalt when it is operational in 2023.

America’s Electric Vehicle Future

The auto industry’s future “is electric, and there’s no turning back,” according to President Biden. It’s expected that EV sales in the U.S. will grow from around 500,000 vehicles in 2021 to over 4 million in 2030.

With rising government support and consumers embracing electric vehicles, securing the supply of the materials necessary for the EV revolution will remain a top priority for the country.

"electric" - Google News

January 21, 2022 at 04:50AM

https://ift.tt/3Ky3gyi

Visualizing America's Electric Vehicle Future - Visual Capitalist

"electric" - Google News

https://ift.tt/2yk35WT

https://ift.tt/3bbj3jq

No comments:

Post a Comment