- From the VW ID.3 and ID.4 to this solar-powered ship called the Silent-Yacht 50, VW is ready to spread its EV love around as part of its overall promotion of electromobility.

- VW is partnering with Austrian builder Silent-Yachts and VW division Seat's Cupra on the electric boat, which will use VW's batteries, pulse-controlled inverters, and electric motors.

- We're starting to detect a bit of a trend here, since both Toyota and BMW have also looked for ways to adapt their zero-emission powertrains to the open seas.

For millennia, watercraft were the only zero-emission vehicles on the planet. But then along came wheels and then diesel engines and bunker fuel, and things got messy. Sure, sailboats have always kept their carbon-neutral propulsion system, but they're about to be joined by solar-powered yachts powered with help from Volkswagen.

Working with solar-electric yacht company Silent-Yachts, VW is adapting its MEB modular e-drive system (as seen in the ID.3, for starters) for use on the open seas. The two companies started working together in 2019. Silent-Yachts founders Heike and Michael Köhler have been trying to find a greener way to plow the seas since starting research on alternative-energy yachts in 2005. They built the first oceangoing yacht to "exclusively use solar energy not only for the actual propulsion, but also to power all the equipment on board" in 2009. That ship, called the Solarwave 46, turned into a business with 400 employees that has built a dozen solar-powered catamarans since then.

Now, Silent-Yachts and VW will take the automaker's modular electric vehicle platform, called MEB, to the water as a way to reduce the costs of making zero-emission ships. As with wheel-based EVs, VW says that using an electric powertrain means "maintenance and servicing are reduced compared to a conventional yacht, as the electric drive system is less susceptible to repair than conventional engines."

VW-powered ship will be called the "Silent Yacht 50" and will use batteries, pulse-controlled inverters, and electric motors from VW. The inverter will be programmed differently for use in the ship instead of a car, and Silent-Yachts will also change some of the software interfaces to suit its needs. The Silent Yacht 50 will be able to use up to six batteries and have 500 kW of power.

Volkswagen says its expansion to yacht building partnerships is a way both to encourage excitement about electric vehicles in general and to prove that "driving pleasure, long ranges, quiet cruising, and clean mobility are also possible on the high seas." The one asterisk there is that while battery-powered yachting is entirely possible, all of Silent-Yachts' models have a backup diesel generator onboard in case of emergencies.

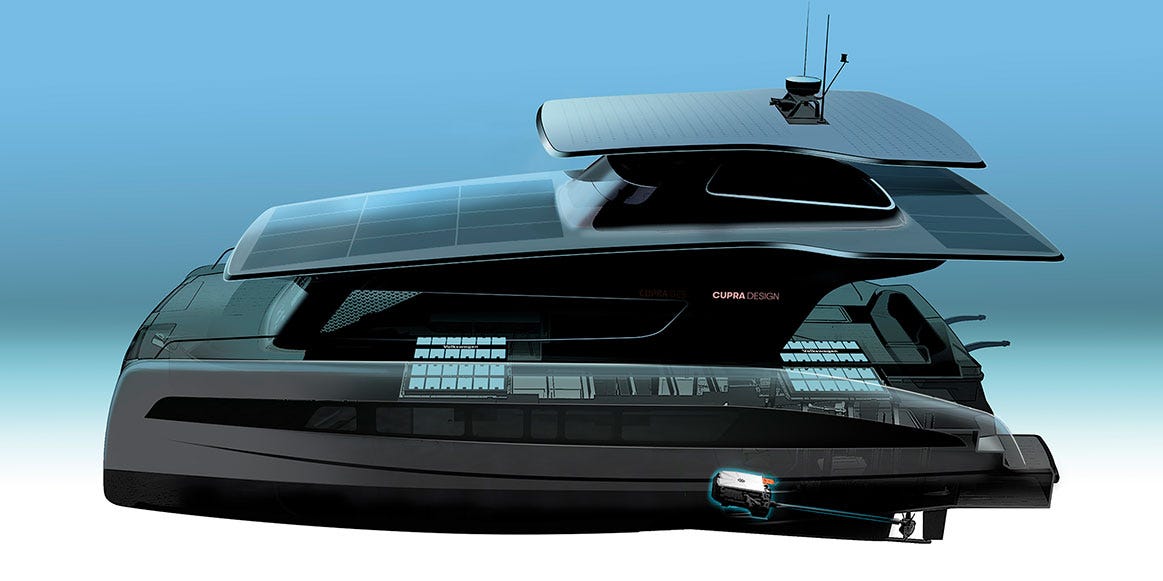

So, VW supplies the powertrain, Silent-Yachts brings the shipbuilding experience, and that leaves room for a third partner, Seat's performance brand Cupra, to help with design. The automotive designers at Cupra "had to think in completely different terms of dimensions, proportions, and surfaces," VW says, as they worked on the Silent Yacht 50. We say the results speak for themselves, with renderings that look sleek and ready for action.

We have to wait to see the first physical MEB-powered yacht, though, as it won't hit the waves until 2022, if everything goes according to plan. From there, Silent-Yachts will ramp up production over four years until it reaches the capability to make 50 ships a year.

Volkswagen has made bold claims about the power of batteries before, not only for wheeled transportation. Battery-powered options "are considered by experts to be one of the best choices for vehicles that combat climate change," the company said last September in a corporate blog post about "Why battery power will drive the future of transportation."

VW is not the only company interested in adapting a zero-emission powertrain for boating. Toyota and Yanmar used hydrogen tanks from the Mirai fuel-cell car for a zero-emission boat concept last year. In 2019, BMW and Torqeedo adapted batteries from the i3 and i8 for marine use in the company's electric boats.

This content is imported from {embed-name}. You may be able to find the same content in another format, or you may be able to find more information, at their web site.

This content is created and maintained by a third party, and imported onto this page to help users provide their email addresses. You may be able to find more information about this and similar content at piano.io

"electric" - Google News

February 01, 2021 at 04:00AM

https://ift.tt/3r2f2Gm

VW's MEB Electric-Vehicle Components Will Power Solar Yachts in 2022 - Car and Driver

"electric" - Google News

https://ift.tt/2yk35WT

https://ift.tt/3bbj3jq