Today we’ll evaluate Elma Electronic AG (VTX:ELMN) to determine whether it could have potential as an investment idea. Specifically, we’ll consider its Return On Capital Employed (ROCE), since that will give us an insight into how efficiently the business can generate profits from the capital it requires.

Firstly, we’ll go over how we calculate ROCE. Then we’ll compare its ROCE to similar companies. Finally, we’ll look at how its current liabilities affect its ROCE.

What is Return On Capital Employed (ROCE)?

ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. Generally speaking a higher ROCE is better. In brief, it is a useful tool, but it is not without drawbacks. Author Edwin Whiting says to be careful when comparing the ROCE of different businesses, since ‘No two businesses are exactly alike.

So, How Do We Calculate ROCE?

Analysts use this formula to calculate return on capital employed:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets – Current Liabilities)

Or for Elma Electronic:

0.10 = CHF6.5m ÷ (CHF94m – CHF30m) (Based on the trailing twelve months to December 2019.)

So, Elma Electronic has an ROCE of 10%.

Check out our latest analysis for Elma Electronic

Is Elma Electronic’s ROCE Good?

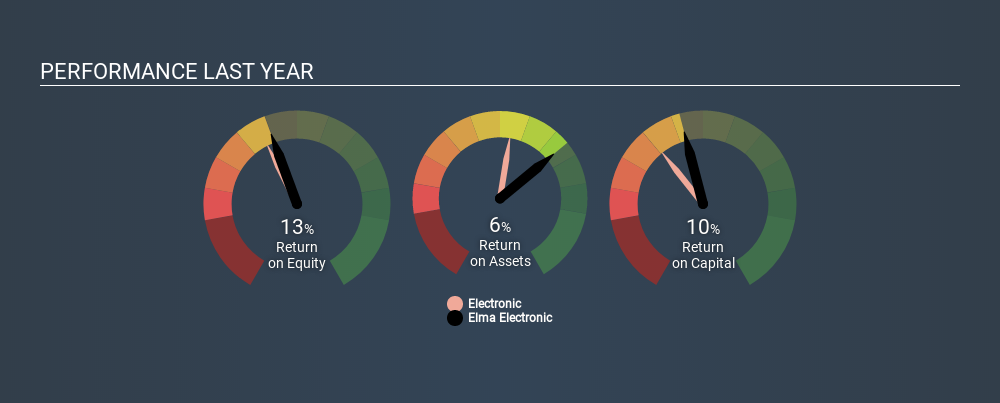

When making comparisons between similar businesses, investors may find ROCE useful. It appears that Elma Electronic’s ROCE is fairly close to the Electronic industry average of 11%. Regardless of where Elma Electronic sits next to its industry, its ROCE in absolute terms appears satisfactory, and this company could be worth a closer look.

We can see that, Elma Electronic currently has an ROCE of 10% compared to its ROCE 3 years ago, which was 7.4%. This makes us wonder if the company is improving. You can click on the image below to see (in greater detail) how Elma Electronic’s past growth compares to other companies.

When considering this metric, keep in mind that it is backwards looking, and not necessarily predictive. ROCE can be deceptive for cyclical businesses, as returns can look incredible in boom times, and terribly low in downturns. This is because ROCE only looks at one year, instead of considering returns across a whole cycle. How cyclical is Elma Electronic? You can see for yourself by looking at this free graph of past earnings, revenue and cash flow.

Do Elma Electronic’s Current Liabilities Skew Its ROCE?

Current liabilities are short term bills and invoices that need to be paid in 12 months or less. The ROCE equation subtracts current liabilities from capital employed, so a company with a lot of current liabilities appears to have less capital employed, and a higher ROCE than otherwise. To check the impact of this, we calculate if a company has high current liabilities relative to its total assets.

Elma Electronic has current liabilities of CHF30m and total assets of CHF94m. As a result, its current liabilities are equal to approximately 32% of its total assets. Elma Electronic has a medium level of current liabilities, which would boost the ROCE.

The Bottom Line On Elma Electronic’s ROCE

With a decent ROCE, the company could be interesting, but remember that the level of current liabilities make the ROCE look better. Elma Electronic looks strong on this analysis, but there are plenty of other companies that could be a good opportunity . Here is a free list of companies growing earnings rapidly.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

These great dividend stocks are beating your savings account

Not only have these stocks been reliable dividend payers for the last 10 years but with the yield over 3% they are also easily beating your savings account (let alone the possible capital gains). Click here to see them for FREE on Simply Wall St."Electronic" - Google News

June 08, 2020 at 11:33AM

https://ift.tt/2Yd3zXD

Is Elma Electronic AG’s (VTX:ELMN) 10% Return On Capital Employed Good News? - Simply Wall St

"Electronic" - Google News

https://ift.tt/3dmroCo

https://ift.tt/3bbj3jq

No comments:

Post a Comment